south dakota sales tax rate changes 2021

Look up 2021 sales tax rates for St Charles South Dakota and surrounding areas. The 2018 United States Supreme Court decision in South Dakota v.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

South Dakotas unemployment tax rates are not to change for 2021 a spokeswoman for the state Department of Labor and Regulation said Aug.

. June 2021 Sales Tax Changes - 302 changes in 26 states. Wayfair Inc affect South Dakota. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

Outlook for the 2019 South Dakota income tax rate is to remain unchanged at 0. What Rates may Municipalities Impose. The sales tax jurisdiction name is Gregory which may refer to a local government division.

Simplify South Dakota sales tax compliance. South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year.

Enter a street address and zip code or street address and city name into the provided spaces. Look up 2021 sales tax rates for Day County South Dakota. 31 rows South Dakota SD Sales Tax Rates by City The state sales tax rate in.

Tax rates provided by Avalara are updated monthly. Change Date Tax Jurisdiction Sales Tax Change Cities Affected. South Dakota has no state income tax.

The Kyle South Dakota sales tax rate of 45 applies in the zip code 57752. The 45 sales tax rate in Fairfax consists of 45 South Dakota state sales tax. South Dakota income tax rate and tax brackets shown in the table below are based on income earned between January 1 2021 through December 31 2021.

Look up 2021 sales tax rates for Turner County South Dakota. State State Sales Tax. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. Raised from 45 to 65 Willow Lake Garden City Raymond Bradley and Vienna. The state sales and use tax rate is 45.

An alternative sales tax rate of 45 applies in the tax region Jackson which appertains to zip code 57752. Municipalities may impose a general municipal sales tax rate of up to 2. Did South Dakota v.

Searching for a sales tax rates based on zip codes alone will not work. There is no applicable county tax city tax or special tax. City january 2021 rate general code january 2021 rate tax code lodging eating establishments alcohol admissions aberdeen 200 001-2 100 1 x akaska 200 004-2 alcester 200 006-2 alexandria 200 007-2 alpena 100 009-2 andover 200 011-2 arlington 200 013-2 armour 200 014-2 artesian 200 015-2 ashton 200 016-2.

1 2021 tax rates for experienced employers are to be determined with Schedule B the spokeswoman told Bloomberg Tax in an email. Remember that zip code boundaries dont always match up with political boundaries like Kyle or Shannon County so you shouldnt. The state sales tax rate in South Dakota is 45 but you can customize this table as needed to reflect your applicable local sales tax rate.

Only the Federal Income Tax applies. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. South Dakota is one of seven states that do not collect a personal income tax.

10 rows Raised from 45 to 65. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. South Dakota state income tax rate for 2021 is 0 because South Dakota does not collect a personal income tax.

South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Has impacted many state nexus laws and sales tax collection requirements. Click Search for Tax Rate.

What is South Dakotas Sales Tax Rate. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. 38 rows 2021 State.

Tax Rate Starting Price. Tax rates provided by Avalara are updated monthly. Tax rates are provided by Avalara and updated monthly.

If you need access to a regularly-updated database of sales tax rates take a look at our sales tax data page. You can print a 45 sales tax table here. To review the rules in South Dakota visit our state-by-state guide.

For additional information on sales tax please refer to our Sales Tax Guide PDF. South Dakota has a higher state sales tax. We provide sales.

The South Dakota sales tax and use tax rates are 45. However revenue lost to South Dakota by not having a personal income tax may be made up through other state-level taxes such as the South Dakota. The Canton sales tax rate is.

As of January 1 2021. There are approximately 1296 people living in the Kyle area. The South Dakota Department of Revenue administers these taxes.

Updated State And Local Option Sales Tax Tax Foundation

Sales Use Tax South Dakota Department Of Revenue

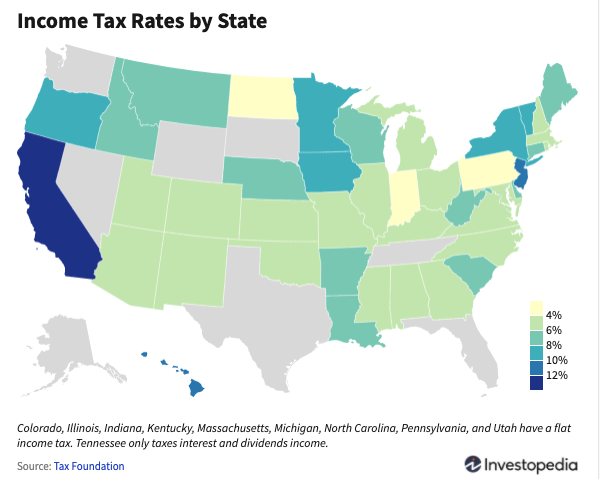

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Sales Use Tax South Dakota Department Of Revenue

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Qod Updated How Many States Do Not Have State Income Taxes Blog

Sales Use Tax South Dakota Department Of Revenue

North Carolina Sales Tax Small Business Guide Truic

Ranking State And Local Sales Taxes Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

Navigating Freelance Taxes In 2020 Managing Finances Filing Taxes Tax

States With Highest And Lowest Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Use Tax South Dakota Department Of Revenue